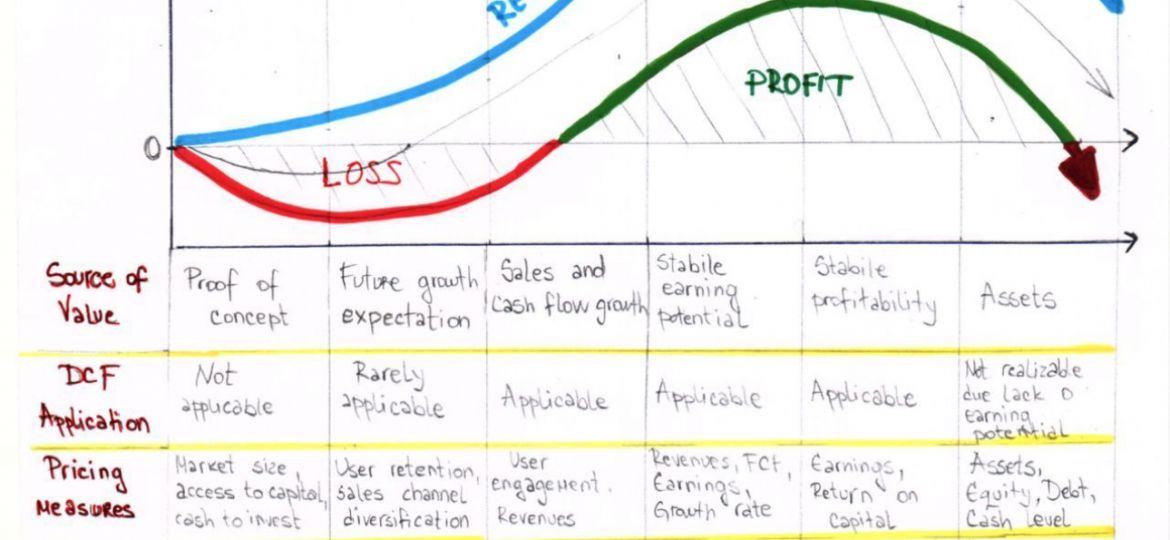

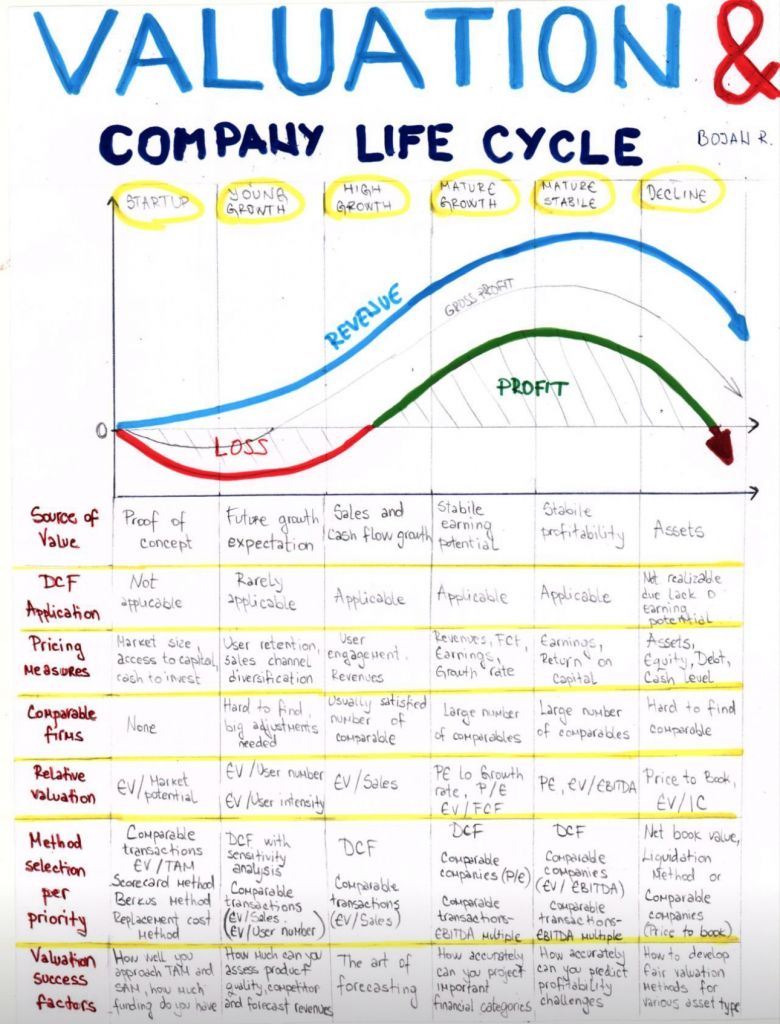

Valuation of firm depends on stage in its life cycle. Look at full approach:

There are 6 stages:

1. Starup

2. Young growth

3. High growth

4. Mature growth

5. Mature stabile

6. Decline

Before valuation it is useful to determine which stage company belongs in.

For example, if the company is in mature growth stage then:

• Source of Value is stabile earning potential

• DCF is applicable

• Relative valuation is applicable too

• Pricing measure are : Revenues, Earnings, Growth rate, FCF

• Valuation ratios could be : PE to Growth rate, P/E, EV/FCF

• Preferable method:

👉 DCF

👉 𝘈𝘭𝘵𝘦𝘳𝘯𝘢𝘵𝘪𝘷𝘦 𝘰𝘳 𝘥𝘰𝘶𝘣𝘭𝘦 𝘤𝘩𝘦𝘤𝘬:

• Comparable companies (P/E)

• Comparable transactions – EBITDA multiple

The success of valuation lays in how well you create a projection of each important financial categories

Look the other stages a well.

~~~~~~~~~~~

Want to establish yourself as a trusted advisor in matters related to company valuation. Check my valuation tutorial with excel models

👉 https://lnkd.in/dE4MDUmh